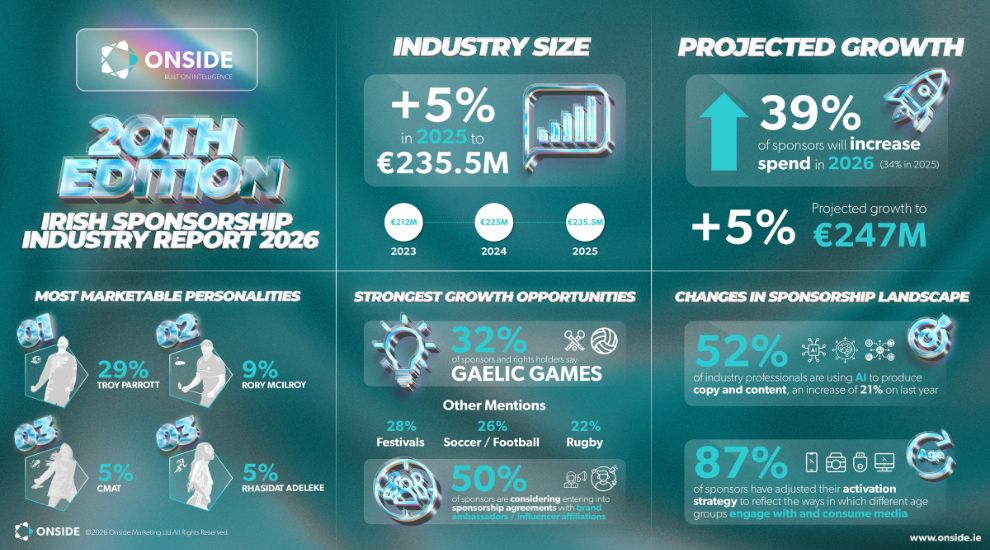

The Irish sponsorship market is set for another year of growth in 2026, with total investment projected to rise to €247 million, up 5 per cent on the €235.5 million recorded in 2025, according to the 20th edition of the annual Irish Sponsorship Industry Survey published by ONSIDE.

The latest figures underline a sector that continues to outperform expectations. At the end of 2024, just 34 per cent of sponsors anticipated increasing their spend during 2025, yet when the year concluded, 57 per cent reported that they had in fact invested more. That momentum appears to be carrying forward, with 39 per cent of sponsors now planning to increase spend again in 2026, compared with 18 per cent who expect to reduce their investment.

While overall confidence remains strong, the survey also points to a more dynamic and competitive marketplace. Demand for sponsorship properties is resilient, with four in ten sponsors actively considering new partnerships. However, exit intentions have also risen sharply. After falling to a historic low of 23 per cent last year, 36 per cent of industry professionals now say they intend to exit at least one sponsorship agreement, signalling a more fluid and active landscape in the year ahead.

As for where future growth is likely to come from, sport continues to dominate sponsor interest. Gaelic Games has moved into first place as the most promising platform for sponsorship, overtaking rugby, with festivals ranked second overall. Football has also risen in prominence, buoyed by the excitement surrounding Ireland’s November qualification for the FIFA World Cup play-offs, which has reignited mainstream and commercial interest in the game.

Emerging participation-led sports are also gaining traction. Padel and Hyrox both rank among the top 10 most promising sponsorship platforms for the first time, reflecting shifting consumer behaviour towards fitness, lifestyle, and community-driven sporting experiences.

That renewed focus on soccer is mirrored in attitudes towards athlete marketability. Ireland international Troy Parrott has been voted the most marketable personality for personal endorsement deals in 2026, reflecting both his on-field profile and broader commercial appeal.

Golfer Rory McIlroy ranks second following his achievement of a career grand slam, while musician CMAT and Olympic finalist Rhasidat Adeleke place joint third, highlighting the widening scope of sponsorship beyond traditional sporting heroes.

One of the clearest trends identified in the survey is the rapid growth of brand ambassador and influencer partnerships. ONSIDE tracked a record number of such deals in 2025, with the volume doubling the previous high set in 2022. That trajectory looks set to continue, with 50 per cent of sponsors saying they are considering entering into brand ambassador or influencer affiliation agreements in 2026.

“The landscape is evolving with brands harnessing personalities who can build and sustain an audience, not just those who perform on their respective sporting field,” said Kim Kirwan, Director of Intelligence and Insight at ONSIDE.

“The talent pool is widening beyond the worlds of sport and entertainment to include content creators, with brands favouring those personalities who can connect with audiences and maintain relevance throughout the year and not just during sporting moments.”

The appeal of these partnerships is particularly strong among younger audiences. Separate public research conducted by ONSIDE alongside the industry survey shows that 68 per cent of under-25s believe it is a good idea for companies to align with personalities, while 77 per cent recognise influencer or personality endorsements as an effective form of sponsorship.

Technology is also reshaping how sponsorships are planned, activated and evaluated. Artificial intelligence is increasingly being adopted across the industry, with current usage largely focused on copy and content production. Looking ahead, data analysis is the leading intended application, with almost four in ten sponsors planning to use AI tools for the first time in 2026.

Despite the emergence of new technologies, social media remains central to sponsorship activation, with nearly eight in ten sponsors expecting to increase their use of social platforms in the year ahead.

Another notable development during 2025 was the rise of beauty and personal care brands within the Irish sponsorship market, reflecting similar trends in international markets. As premiumisation accelerates and beauty brands seek deeper cultural relevance, a distinct new category has begun to emerge.

In 2026, both domestic and international beauty brands are expected to explore opportunities ranging from individual athlete partnerships to league and competition-level associations. For rights holders, the challenge will be to develop compelling and authentic propositions for a category that is still relatively new to sport sponsorship.

Kirwan said that while the headline indicators point to a healthy market, increased growth has also brought added complexity.

“The sponsorship landscape is now more fragmented, both in terms of the range of assets and properties available and the ways in which audiences engage with content across multiple platforms,” she said. “As a result, engaging, well-executed activations that span multiple media channels are increasingly critical.”

She added that scrutiny around return on investment is intensifying, placing greater emphasis on measurement, accountability and strategic alignment.

“In this environment, the most successful sponsorships are those that combine creativity with clarity of purpose, ensuring investment delivers tangible and measurable value.”

Image Credit: ONSIDE

Event Tickets

Upcoming Events

SPORT FOR BUSINESS

Sport for Business is Ireland’s leading platform focused on the commercialstrategic and societal impact of sport. It connects decision-makers across governing bodies, clubs, brands, agencies and public institutions through high-quality journalism, events and insight. Sport for Business explores how sport drives economic value, participation, inclusion and national identity, while holding organisations to account on governance and sustainability.

Through analysis, storytelling and convening the sector, it helps leaders understand trends, share best practice and make better-informed decisions. Its work positions sport not just as entertainment, but as a vital contributor to Ireland’s social and economic fabric.

Find out more about becoming a member today.

Or sign up for our twice-daily bulletins to get a flavour of the material we cover.

Sign up for our News Bulletins here.